Friday, October 26, 2012

Cars Donation Process

Charity organization except your vehicle (car, truck, RV, boat, or plane) in any condition, running or not. Because it still can be sell.

Once they receive your information, they will make an initial determination whether your vehicle may be suitable to be used as a “program car” (to be provided to a client) or whether the vehicle will be sold at auction or for salvage.

What If Your Vehicle Is To Be Sold? If your vehicle is not suitable to be a “program car”, they will mail you a letter stating that “your vehicle does not meet our criteria to be a program car and will be sold”. This letter may be used for tax purposes for you to value the donation up to $500, it serves as your receipt. Once the vehicle is sold, if the gross sales price is more than $500 you will be sent an additional receipt within the next 30 days of the sale that will include the sales price that you must use to value your donation.

When to schedule The Vehicle Pickup? One of their towing companies will contact you to schedule a convenient time to pick up your vehicle at no charge. As I said in my older post, this will reduce your donation value, because there are some expenses that charity organization must pay to this towing company for towing you car donation.

What is Program Vehicles? If your vehicle is tentatively accepted to be used as a “program car” they will mail you a letter stating that “based on the information that you have provided regarding the condition of your vehicle, your vehicle (car-boat) may be used in our program and will be provided to a disadvantaged person. (Included in this letter will be a summary of the condition of the vehicle that you are donating. If there are any disagreement please contact us immediately.) If the condition of the vehicle has been surely conveyed to our representatives, then your vehicle will be used as a “program car” and will be provided to a client and they will send you a receipt (within 30 days of the pick up) stating that you may deduct the “fair market value” of your donation.

How is Determining “Fair Market Value”? According to the IRS, the donor, must determine the value of their vehicle donation (not the recipient charity). If you confused how to determine it, assistance in determining the “fair market value” can be found at www.kbb.com Kelly Blue Books’ website. The Donors that valuing their donation in excess of $5000 must acquire an independent appraisal.

Car Donation California story

Car Donation California story. Stephen is 28 years-old and has had his 1982 ford since he was 21. It’s amazing that car last that long. Throughout the past few years, Stephen has really been focusing on his future. He has started savings accounts, created budgets for himself & building his career. Unfortunately, his old ford who he liked to call “Big Bird” broke down for the last time just a little while ago, in January for exactly. Knowing that it just wasn’t worth fixing it again, he decided that he would use the financial stability--that he had built into his lifestyle to his advantage. He decided buy a new car, the latest ford. A young “Big Bird”

So there was Stephen in the new car dealership, he fell in love with his new truck. However, the dealership only offered him $300 as trade in value for Big Bird & he was not satisfied about it. He thinks it’s worth more than that, he figured he would rather give it to a charity that could use that small amount of money to do big things! After searching for “car donation california“, Stephen came across with some website! Learn about car donation, tax deduction, he decided after reading through it that he would donate the car through a certain charity organization. It was water for people organization. When he donated his car, he got tax deduction.

Meet Aabida Sadila. Aabida Sadila lives in the war torn country of Iraq. Unfortunately amongst many other necessities, water is a scarcity for many in her small community in Iraq. As a matter of fact, Aabida Sadila has to walk with her 2 children and other villagers’ to the closest pond to get drinking water. It is the same pond that used by the entire community to bath. This pond has been the reason for countless instances of death and disease. Fortunately however, Water For People was able to provide much needed relief to Aabida Sadila and the many people in her community. So, another death and disease may reduce.

Something that Stephen may never know is that his car donation amongst many others given by people just like him was the reason a new pond was able to provide Aabida Sadila and her community the clean drinking water that they were finally able to enjoy! So, thank you for your generosity. Let’s be a better person, the one who do good deeds for others.

Wednesday, October 24, 2012

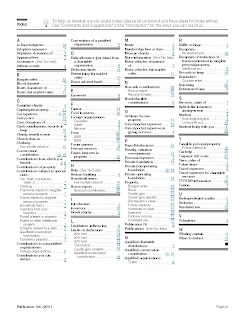

Charitable Contribution-Publication 526_Page_1-24

Here

are Charitable Contribution-Publication 526 from IRS of United State of

America. It will give you a bunch of info about charity, car donation,

qualified organization, tax deduction.

There are charitable contribution that can be deductible and not deductible you tax. If you have student exchange program living with you, he or she are not your relatives, you'll get deductible tax.

What is Fair Market Value? find it in our attachment.

There are charitable contribution that can be deductible and not deductible you tax. If you have student exchange program living with you, he or she are not your relatives, you'll get deductible tax.

What is Fair Market Value? find it in our attachment.

Labels:

car donation USA,

Charitable Contribution-Publication 526 from IRS,

charity,

tax deduction,

usa

Tuesday, October 23, 2012

Publication IRS for Car Donation

Here are some publication from IRS about car donation in United State of America, you might wanna look at it. It will give you a lot of information about car donation, tax deduction, organization for charity.

There are lots of example if you donate that car, the price, deduction, fair market value etc.

Types of Qualified Organizations to receive Deductible Contributions.

Here are five general types of organizations to receive Deductible Contributions.:

1. Community Chest organizations, fundraising organizations that collected money from workers and local businesses and then distributed it to community projects. Such as : religious purposes, charitable purposes, scientific purposes, literary purposes, educational purposes, children and animal prevention from cruelty.

2. War vets (veteran) organizations. Effect from active military service can be profound and everlasting, and some veterans have found it hard to adjust to normal life again. Suffering from post combat mental health problems such as depression and post-traumatic stress disorder.

3. The Domestic Fraternal Societies. Your contribution to this societies is deductible only if it to be use as Community Chest (charitable, religious, scientific, literary, educational, prevention of cruelty to children or animal).

4. Nonprofit Cemetery. Your contribution to this type will not deductible if it can be used for the care of a specific mausoleum crypt.

5. The United State or any state, district of Columbia, US possession (including Puerto Rico), political subdivision of a state, Indian tribal government or any of its subdivision that perform government function. Your contribution to this type must be made solely for public purposes.

So, make sure your car donation will be in those five types organization, otherwise no deduction can be claim.

Sunday, October 21, 2012

3 Tips how to donate your car (additional)

1. Ask them how is your car-donation will be handled. You'll want to know that the vehicle will be picked up and transported by properly licensed and insured towing companies, that mean it will have to pay someone to pick up your car for you. To help the charity maximize the benefit of your donation, drop the car or boat off yourself.

2. Get a receipt. Your estimate of the donation’s value probably won’t cut it. If the car is worth more than $500, the donor must complete Section A of IRS Form 8283 and attach it to their tax return. The IRS is going to want to see evidence of how much the charity got for it. (Most charities that accept these donations turn around and sell them for cash.) You will need to get a receipt from the charity revealing exactly how much money it made.

3. Make sure your money for a good deed. Ask where and how the money will be spent. This question should be easily answered. You should search for agency or the charity that makes the best use of the funds from your auto donation. Beware of charity car donation programs that promise to send proceeds to any organization without having a direct relationship. All charities aren’t created equal, and all car donation programs aren’t run with the same attention to donor wishes.

2. Get a receipt. Your estimate of the donation’s value probably won’t cut it. If the car is worth more than $500, the donor must complete Section A of IRS Form 8283 and attach it to their tax return. The IRS is going to want to see evidence of how much the charity got for it. (Most charities that accept these donations turn around and sell them for cash.) You will need to get a receipt from the charity revealing exactly how much money it made.

3. Make sure your money for a good deed. Ask where and how the money will be spent. This question should be easily answered. You should search for agency or the charity that makes the best use of the funds from your auto donation. Beware of charity car donation programs that promise to send proceeds to any organization without having a direct relationship. All charities aren’t created equal, and all car donation programs aren’t run with the same attention to donor wishes.

Labels:

car donation USA,

charity,

donation,

IRS,

tips how to donate your car

4 Tips How To Donate Your Car To Charity

Maybe it sounds simple: “Donate your used car to charity. Avoid the hassles associated with selling it. Score a tax deduction at the same time. Everybody happy, right?” Not necessarily. As the saying goes, the road to hell is paved with good intentions, and it can be surprisingly easy to fumble this well-meaning act.

Read the following tips to be sure you’re making the right moves, before you decide to hand one of your biggest assets over to anyone:

1. Find a qualify charity. Make sure the charity is eligible to receive tax deductible contributions. Ask for a copy for your records of the organization’s IRS letter of determination which verifies its tax exempt status. If the charities you normally support aren’t equipped to accept such donations, do some homework until you find a reputable charity that is. You can research charities’ track records online.

2. Avoid brokers or middlemen. Lots of profit intermediary organizations advertise aggressively on billboards, TV and elsewhere, offering to help you donate your vehicle to charity. Here’s the catch: These organizations typically keep about 40 percent to 90 percent of the vehicle’s value for themselves, and the charities don’t get what they could have gotten. To prevent this, check directly with charities you admire and find out whether they accept car or vehicles donations.

3. Do the math. Due to the proliferation of car donations, the IRS became increasingly concerned about how taxpayers valued the vehicles they donated to charity. If you still feel compelled to use an intermediary organization (possibly because you’re busy) at least ask the organization how much of the car or vehicles value will go to charity. If the organization simply gives charities flat fees (say, $100 for a used vehicle regardless of its value, or $2,000 a month) your donation may not be eligible for a tax deduction.

4. Know your recipient. In order for you to qualify for a deduction, the charity that gets your donation must be an IRS-approved 501(c)(3) organization. Your mosque, church, synagogue or temple likely qualifies. (Check first just to make sure.). Remember that you're still making a charitable donation, and don't simply give your automobile away to any charity, just because they're a charity. Do a little research, and find a high-performing charity that does the kind of work you like, in the region you wish to target, and does that work well. You also can visit the Internal Revenue Service’s Web site and search for Publication 78 to find other qualifying non-profit organizations. (Just type “78” into the search field on the IRS home page and you’ll be directed to the right publication.)

Labels:

avoid,

car donation USA,

charity,

IRS,

math,

qualify charity,

recipient,

tips how to donate your car

Subscribe to:

Comments (Atom)

H

H

-car-donation-california-vehicle.jpg)